stock code:002252 stock name:shanghai raas

abstract of 2014 annual report of shanghai raas

i important notice

the content of this abstract is from the annual report. pls. refer to the annual report disclosed in the news paper or on the web-site.

introduction of the company

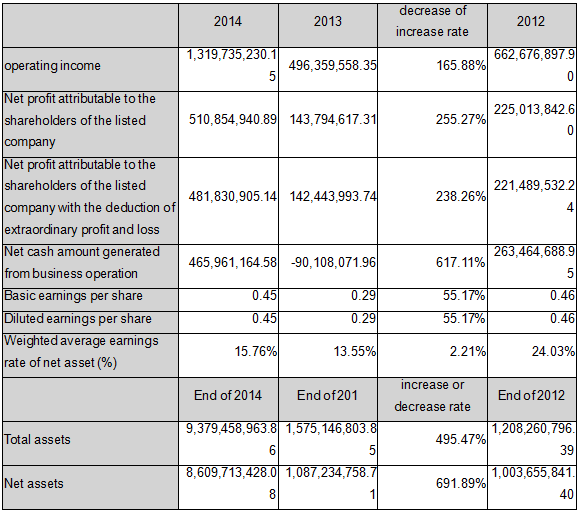

ii main financial data and change of shareholders

(1)main financial data

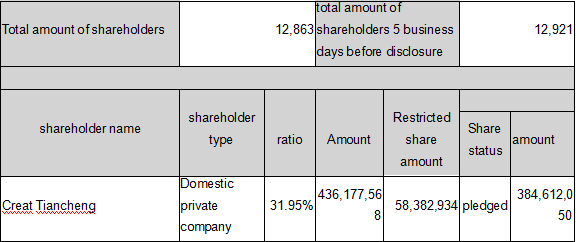

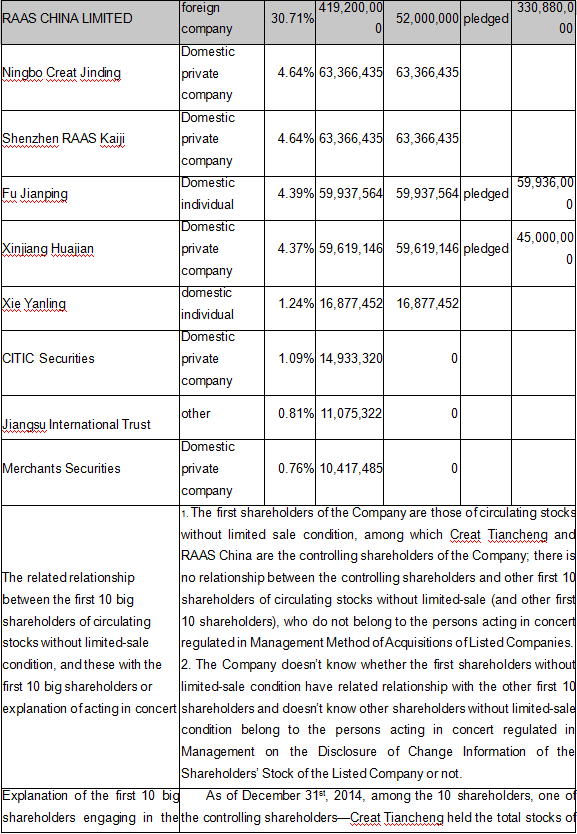

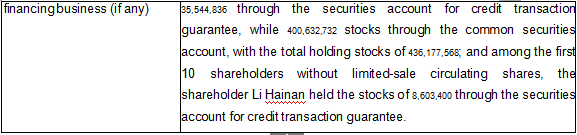

(2)top 10 shareholders table

(3) preferred top 10 shareholders

there is no preferred shareholder in the company.

(3)the controlling chart of the company

iii discussion & analysis of the management

(1)overview

shanghai raas goes for an extraordinary year in 2014, which is a year with milestone significance in its development. during this year, the company issued stocks to purchase assets and finished the acquisition and reorganization for two times, finished the incentive plan of stock option and restricted stocks and used idle selfunds to make investment. the company developed very quickly in 2014, meanwhile the operating results of 2014 was remarkable as well. by the end of 2014, the total assets of the company reached 9,379,000,000 yuan, which is 5.95 times of 1,575,000,000 yuan of 2014. the business operating income of 2014 is 1,320,000,000 yuan, with an increase of 165.88% compared 496,000,000 yuan of 2013. the net profit attributable to the shareholders of the listed company is 511,000,000 yuan , with an increase of 255.27% compared with that of 2013.

1. major assets reorganization

1) on january 19th, 2014, the company received the approval about verifying shanghai raas blood products co., ltd offering and purchasing assets to finance the supplementary funds to creat tiancheng investment holding co., ltd authorized from china securities commission (zheng jian xu ke no. [2014]123); and the company was verified to issue the total stocks of 93,652,444 to the special objects of creat tiancheng, xinjiang huajian, fu jianping and xiao xiangyang for purchasing 100% equities of banghe pharma; meanwhile, issue the total stocks of 26,000,000 for supplementary funds to raas china for sustainable development of banghe pharma and supplementation of the operating funds of the company. such newly added stocks of 93,652,444 and 26,000,000 were listed in shenzhen stock exchange on february 20th, 2014 and june 16th, 2014 respectively, which means the completion of major assets reorganization of banghe project of the company.

2) on december 19th, 2014, the company received the approval about verifying shanghai raas blood products co., ltd offering and purchasing assets to finance the supplementary funds to ningbo creat jinding investment partnership enterprise (limited partnership) authorized from china securities commission (zheng jian xu ke no. [2014]1373); and the company was verified to issue the total stocks of 143,610,322 to creat jinding for purchasing 89.77% equities of tonglu biology; meanwhile, issue new stocks in non-public way to finance supplementary funds to not more than 10 specific objects. such newly added stocks of 143,610,322 were listed in shenzhen stock exchange on december 25th, 2014 and now the financing work is actively under progress.

through two m&a, the blood products of the company increased from the original 7 to 11. it also includes immunoglobulin products besides alb, ivig and blood coagulation factor products. besides the blood products, the company also has traditional chinese medicines and the product variety expanded. the plasma centers increased from 12 to 28, with the plasma quantity and capacity increased and doubled. at present, shanghai raas stands in the leading position of the domestic blood products whatever in the product variety and the plasma scale.

2. stock incentives

on june 9th, the company started to initiate stock incentive issues and agreed to grant the stock option and restricted stocks to the incentive objects including the directors, senior management personnel, medium management personnel, core technician and business backbone in the way of issuing new stocks under the grant condition in accordance with the rule of the company.

on august 6th, 2014, the company got the filing in china securities regulatory commission without any objection and made the announcement.

on december 10th, 2014, the company finished the grant registration of the involved stock option and restricted stocks. the quantity of restricted stocks actually purchased this time is 3,126,600 and the grant listed date was december 12th, 2014.

through the stock incentives, the incentive objects including the directors, senior management personnel, medium management personnel, core technician and business backbone are granted with stock option and restricted stocks, which shall further improve the governing structure and perfect the long-term incentive mechanism of the company; advocate the performance culture with value as the guide, establish the interest sharing and restriction mechanism between the shareholders and the management team of the company, effectively arouse the enthusiasm of the management and important backbone, absorb and hold the excellent management talents, technicians and business backbone, and effectively combine the personal interest with that of the company; and advocate the theory of sustainable development for both the person and the company and promote the long-term stable development of the company.

3. wealth management products investment

the company used its own idle funds to make investment under the premise of fully guaranteeing the requirement of daily operation funds and not affecting the normal production and operation of the company and effectively controlling the risk, which shall be good for improving the fund utilization efficiency and fund income lever and increasing the earning capacity of the company.

in april of 2013, the company invested on xingye trust plan. by oct 2014, the compnay gained 24,713,163.35, and the investment return rate is 17.65%.

in september 2014, the company used its own idle funds of rmb 600,000,000 yuan to purchase wealth management product of citic bank. by dec 2014, the financial product expired and the company recovered all principals and gained the profits of rmb 6,731,500 yuan from participating in this trust plan, and the investment profit return rate is 4.50%.

(2)analysis on core competitiveness

the plasma centers were restructured in 2006 in china. the plasma centers all became the subsidiaries of the blood products company. the plasma is always short of supply due to its rareness. if the manufacturers of blood products own more plasma centers to achieve more raw materials, they can get more survival and development space, otherwise, their development shall be restricted. therefore, the resources of plasma center and management on the plasma supplier and scale are still the key points to determine the production scale and industrial role in a long time in the future. thus owning a certain quantity of plasma centers and good management on the centers shall be the basis for the survival and development of the manufacturer of blood products.

as the advanced technical enterprise with foreign investment in shanghai and high-tech enterprise recognized by science and technology commission of shanghai municipality, the company persists in the quality guideline of “safety, excellence and high efficiency” since its establishment and its product occupies the high-end market of the blood products in china, with good reputation in the industry and the consumers.

shanghai raas strictly abides by gmp regulations issued by cfda to carry out its production. the company was the first batch of the blood products companies verified by gmp and the company also abides by the regulation of fda and who. the company passed the verification of iso9001 and was one of the earliest companies to get the iso9001 certificate.

the company became no. 1 in blood products industry after m&a of zhengzhou banghe and tonglu. the comoany is a leading company in terms of products kinds, plasma use efficiency.

1. the plasma centers of the company increased to 28 from 12. the plasma collection amount increase from 400 tons to 900 tons annually. thre are plasma centers in guangdong, inner mongolia, zhejiang besides those in guangxi, hunan, hainan, shanxi and anhui. currently only the company has plasma centers in hainan and inner mongolia. currently the company is no. 1 in plasma collection amount, and the company has potential in set up new plasma center and improving plasma amount.

2. the company’s products increased from 7 to 11, and the company’s market share also will increase. shanghai raas will take full advantage of high yield rate of zhengzhou raas and tonglu and variety of blood coagulation factor products. the company shall concentrated exert the advantages on technology and r&d and learn from other's strong points to make up one's deficiencies to further improve the plasma comprehensive utilization and consolidate the market leading position.

3. the company is experienced in m&a. the company successfully acquired banghe and tonglu in 2014 to become no. 1 in the industry. the company will seek opportunity to go on with m&a in the next 5 years to become a leading company in the world.

(3) vision for future development of the company

(1) competition structure and development trend

at present, the economy in our country enters a new status of power switch and conversion of development way. the sustainability and balance of economy increase are continuously improved and the contribution rate of consumption on the increase is obviously improved. the domestic consumption structure demonstrates personalized and diversified characteristics. as the special consumption goods to guarantee the people’s life and health, the blood product also faces a new chance for development.

from 2004 to 2013, the proportion of the population with the age between 0-14 continuously decreased while that of the population with the age more than 65 continuously increased. it is estimated that the aging population in china shall reach one third of the total population till 2050. the aging trend of population is obvious, which shall bring up the increase of medical industry. in recent years, the clinical usage amount of blood products continuously increases and the market capacity increases too along with the improvement of medical level and perfectness of medical guarantee system. however, the average blood usage amount of our company is still much lower than the international level, it shall keep prompt and continuous growth in the future. however, due to the limit of plasma center resource and mining amount, there is a hug market gap on the blood product of our country. at present, the actual demand of plasma in our country shall be about more than 10000 tons. but the total mining quantity was about 5000 tons in 2013 and the actual input quantity is about 4000 tons. the difference between the supply and demand is more than two times.

the blood product industry has the specificity with the national strategic safety and the blood products have wide range of purposes with obvious rescue effect. china is a country with large population and the blood products relate the people’s life and health, with a certain of scarcity and specificity. the blood product industry relates the national strategic safety, so fostering china world-grade blood product enterprise complies with the development strategy of the industry. on one hand, the national pay much attention to the supervision on the blood products, continuously improves the threshold access to the industry and strictly control the quantity of participant in this industry; on the other hand, since the blood product industry relates the national strategic safety and people’s life and health, fostering china world-grade blood product enterprise complies with the development strategy of the industry, meanwhile, the nation encourages leading enterprises in nine industries including pharmaceutical industry to continuously become larger and stronger through merging and reorganization.

from the international blood product industry, there is large-scale industrial integration since 2014. at present, the industry is highly concentrated. only such several large enterprise as beilin, baxter, bayer, grifols and octapharma have occupied about 70% of the global blood products. now there are nearly 30 blood products enterprises in china, with the scale still much falling behind the foreign enterprises. so the industrial integration is the trend. the integration in blood products industry in our country still stays at the early stage. since 2008, the merging and acquisition of the industrial leading enterprises begins. but compared with the foreign blood enterprises with hundreds of billions market value, the income and profit of domestic enterprises are much lower than the same foreign enterprises and there shall be huge growing space.

(2) development strategy

in the next several years, the company will become a national aircraft carrier in the international blood industry with the endogenous growth as the root and external merging as the span.

internal growth:

(1) to fasten the construction step of the current plasma center and accelerate the layout of newly-built plasma centers;

(2) to enlarge the cooperation with the domestic r&d institutions and input, increase the product variety and improve the comprehensive utilization of plasma;

(3) to strengthen the exploitation efforts in the domestic and oversea market and establish marketing network all around the country.

external m&a:

due to the support of national regulatory policy and trend of industrial development, the concentration degree in the future shall be further improved, the merging is the tendency in the industry and the strong enterprise shall be stronger in the industry. from the sight of the development and growth path of the magnate in the international blood products industry, it is the main path for the prompt development of the company through the external merging when increasing the self-competitiveness. shanghai raas has rich experience on the external merging and integration, and it purchased banghe and tonglu biology successfully in 2014 and realized seamless connection on the integration of these two enterprises. thus, the company has obvious increase in the performance and integration and becomes the leading enterprise in the domestic blood industry. shanghai raas will enlarge the industry integration in the domestic and international market in the next 5 years and overall push forward the development strategy of external merging to try to step into the work-grade blood enterprises as early as possible.

(3) operation plan of 2015

in the beginning of 2014, after the acquisition of zhengzhou raas, the company made preliminary integration management on the product sales and fund allocation. at end of 2014, the company finished the merging of tonglu biology. how to fully exert the advantages of the three companies, realize the resource sharing and complementary advantages to improve the overall competitiveness of the company and consolidate the leading position in the industry is one of the main tasks of 2015.

in 2015, each task of the company will be carried out closely around the development strategy to make it implemented. first, strengthen the construction and management on the mining of blood plasma, r&d and marketing network, fully utilize the inner resources and improve the technical level to keep the sustainable growth; second, actively seek proper merging object and continue to make the enterprise larger and stronger through the merging and reorganization of capital market.

(iv) risk analysis

1. potential risk on product safety

the source of blood products is extracted from the plasma of healthy persons. as per its specialty, this kind of products may suffer major medical accident like the cross-inflection and pathophoresis from blood due to the consideration on quality and safety. meanwhile, there are still many virus not found due to the limitation on the science and technology as well as human recognition level and the potential risk exists that pathophoresis from blood shall be induced due to the unknown virus.

2. risk on insufficient supply of raw material

the raw material of the blood products is the good human plasma. because of its specialty and strong supervision, the plasma supply is very nervous in the whole industry, which shall directly determine the production scale of the blood products.

3. risk on cost rising of plasma

as influenced by such factors as income increase due to outward employment and rising of living cost, the plasma center is faced with the loss of plasma donors. in the future, the subsidy and award for plasma donors may gradually increase.

4. risk on price fluctuation of products

the main products, human albumin and human immunoglobulin for intravenous injection, are both listed to the catalogue of drugs for basic national medical insurance, of which the highest retail price is set by national development and reform commission. in addition, the price shall be floated under the highest retail price according to the situation of different regions and enterprises. with the increase of the product supply in the future, the competition in the market may be aggravated and the national price policy may also be adjusted. if the retail price of human albumin and human immunoglobulin for intravenous injection is reduced by the government in the future, the profit of the company shall fall down.

5. risk of supervision on plasma center

the continuous normative running of the plasma center is very important to the overall operation of the blood product enterprise. although the company has set up a complete set of management systems for such aspects as plasma source development, plasma mining and management on plasma centers and accumulated rich experience, there is still risk due to management and operation strictly against the rules.

iv issue related to financial report

(1) explanation of the changes on the accounting policy, accounting estimation and calculation method as compared with the financial statements of the previous year

√ applicable □ not applicable

on january 5th 2015, the company held the 22nd (temporary) meeting of the 3rd term of the board of directors and the 17th meeting of the 3rd term of the board of supervisors, in which the proposal about alteration on the accounting policy of the company was passed through and it is agreed that the company correspondingly change the accounting policy of the company upon the series of accounting standards successively promulgated since january 26th 2014. the alteration on the accounting policy this time shall not have important influence on the financial statements of the company and the company published the announcement about the alteration on accounting policy of the company in securities times, china securities journal, shanghai securities news and securities daily as well as the website http://www.cninfo.com.cn on january 6th, 2015.

(2) explanation of correction for major errors required for tracing and restatement during the report period

□ applicable √ not applicable

(3) explanation of the changes on the consolidated financial statements as compared with those of the previous year

√ applicable □ not applicable

1. issuing shares to purchase 100% equities of zhengzhou raas blood products co., ltd

as approved by csrc, the company issued a total of 93,652,444 stocks to purchase 100% equities of zhengzhou raas blood products co, ltd (hereinafter referred as “zhengzhou raas”) respectively held by creat tiancheng, xinjiang huajian, fu jianping and xiao xiangyang, according to the proposal about the major assets reorganization through stock issuance to purchase assets and finance supplementary funds and its related transaction passed in the second shareholders’ meeting and the approval of zheng jian xu ke no. [2014] 123 of approval about verifying shanghai raas blood products co., ltd offering and purchasing assets to finance the supplementary funds to creat tiancheng investment holding co., ltd authorized from china securities commission.

2. issuing shares to purchase 89.77% equities of tonglu biological and pharmaceutical co., ltd

the company issued the total 143,610,322 stocks to respectively purchase 89.77% equities of tonglu biological and pharmaceutical co., ltd (hereinafter referred as “tonglu biology”) held by ningbo creat jinding investment partnership enterprise (limited partnership), shenzhen kaiji investment consulting co., ltd and xie yanling, according to the proposal about the major assets reorganization through stock issuance to purchase assets and finance supplementary funds and its related transaction passed in the second shareholders’ meeting and the approval of zheng jian xu ke no. [2014] 1373 of approval on verifying shanghai raas blood products co., ltd offering and purchasing assets to finance the supplementary funds to ningbo creat jinding investment partnership enterprise (limited partnership) authorized from china securities commission dated 19 dec 2014.

the purchase date defined by the company was december 22, 2014. as of this date, the issues about the big assets reorganization were passed through the discussion in the shareholders’ meeting and checked and approved by china securities regulatory commission. the changes on the registration for industry and commerce of tonglu biology have been finished, the stocks used to purchase the assets were issued and the transaction counter-performance was paid, which indicated that the company has finished the acquisition of 89.77% equities of tonglu biology.

(4) explanation from bod and supervisory board on whether the financial report is abnormal

□ applicable √ not applicable

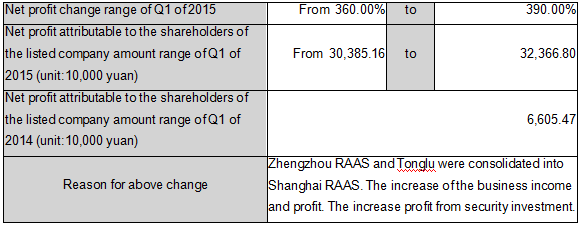

(4)forecast on the business operating results of q1 of 2015

the net profit of q1 of 2015 is positive, and the increase rate is over 50%

signature page of abstract of annual report for 2014)

shanghai raas blood products co., ltd.

legal representative:zheng yuewen

date: 11 feb 2015

links:

internet drug information service certificate :( shanghai) non-operating 2011-0201 九游会论坛 copyright © 2013-2014 shanghai raas all rights reserved powered by

"));